Banking

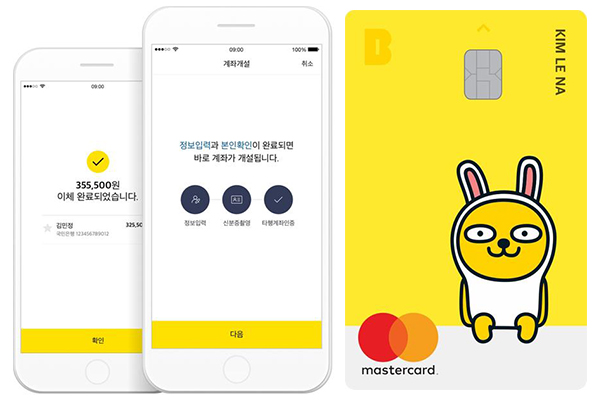

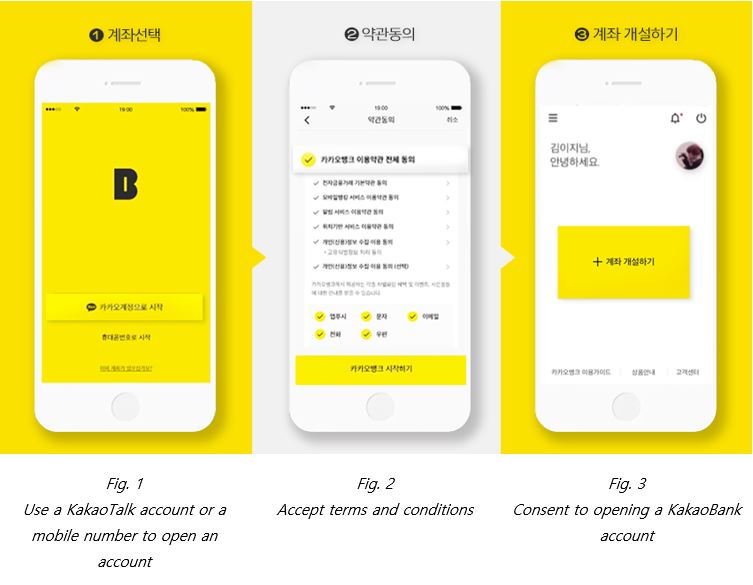

Kakao was approved by South Korean regulators to become the nation's first Internet-only bank in 2017. The Internet bank engages in the same business as commercial banks, including processing deposits, loans and wiring money. Consumers will no longer need to visit a bank to open a new bank account or to get a loan. Kakao's business plan was considered innovative, and the company's business model was expected to secure sizable customer sign-ups relatively easily, based on the users of KakaoTalk, which is the country's most popular messaging application.Although K-Bank eventually became South Korea's first Internet-only bank having been launched several months prior, Kakao Bank immediately attracted more customers; 820,000 within four days of its launch on 27 July 2017. The dedicated Kakao Bank app itself was downloaded 1.5 million times within the same period. The bank had 3.5 million customers after a month. These figures trounced the 400,000 users that K-Bank amassed within 100 days of its existence. By 26 September 2017, Kakao Bank lent ₩1.4 trillion ($1.2 billion), constituting 40 percent of the total loans in all of South Korea for that particular month.  The bank's unprecedented expansion is seen as an exception to the closure of banks, particularly foreign-owned institutions. The fledgling performance for these banks is being blamed on the high cost of maintaining brick-and-mortar operations and the popularity of Internet finance among Korean consumers.

The bank's unprecedented expansion is seen as an exception to the closure of banks, particularly foreign-owned institutions. The fledgling performance for these banks is being blamed on the high cost of maintaining brick-and-mortar operations and the popularity of Internet finance among Korean consumers.